Brides magazine states the common amount spent on a wedding ring involved $eight,800 into the 2018. When you look at the 2017, the common was just throughout the $5,100.

Of course you charges the brand new gemstone toward a charge card one has a grace period, rate of interest charge won’t apply to your daily stability. This means you’ll receive at least three weeks since that time you get the latest ring, towards time you’re going to have to shell out the dough. (The exact elegance period varies of the card company, however the Consumer Monetary Safeguards Agency (CFPB) states brand new card company have to send the bill at the very least 21 months before commission is due). For people who pay the full number your billed with the ring by your monthly payment deadline, the credit card issuer get fundamentally considering your an interest-free financing for a few months.

Specific cards, including the BankAmericard bank card , provide a zero focus basic marketing several months which can allow you up to 1 . 5 years if you don’t could well be billed attract. When delivering another type of credit card , make sure to take a look at duration of the reduced-attention intro period and harmony that with the newest high rates you could discover given that intro period ends.

High desire

If you purchase a good $eight,000 engagement ring which have credit cards who may have a great 15% interest and do not have the money available to blow the balance completely, the expense of proposing can be more than just your budget lets. You may be to make monthly installments for over 2 yrs after you’ve suggested, and can even shell out at the very least $step 1,three hundred a lot more in the attention costs this means that.

Borrowing from the bank use (exactly how much of available borrowing from the bank is in explore) ‚s the second the very first thing on your credit score computation. Experian says cardholders is explore only about 29% of their line of credit at one time . A higher borrowing use may cause a possible financial or creditor to trust you are a dangerous debtor who’s counting also greatly into the credit. For people who costs an effective $5,100000 gemstone into a credit card that have a good $ten,000 borrowing limit no almost every other equilibrium, like, you will have pressed your own credit utilization so you can fifty%.

Once you usually do not afford the balance immediately and commence charging other contents of preparing for your relationship, your use rates usually ascend. Assuming you get almost every other credit cards afterwards, otherwise purchase a home with your new lover, you must have your credit score as all the way to possible.

Suggestions for To acquire a band Having a charge card

- Funds before you could shop. Determine how far you could potentially relatively afford predicated on your earnings, most other costs and you may monetary requirements.

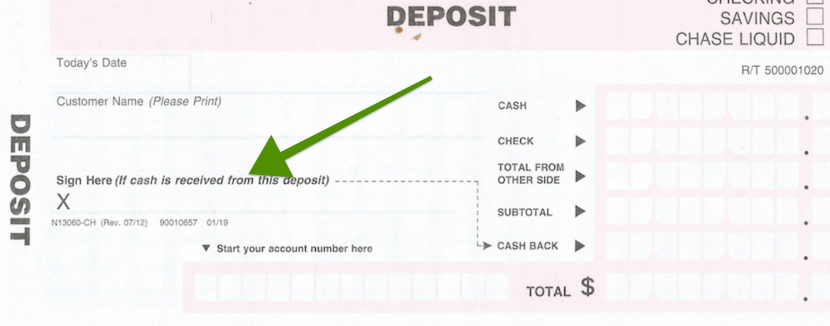

- Start saving today. Calculate just how much you’ll need to save yourself monthly considering after you decide to recommend. Introduce a charge-totally free family savings that shell out your certain interest on your deposit to help you earn more income even though you conserve.

- Invest precisely the sum of money you’ve got protected inside the dollars. (Make sure you remember about transformation income tax otherwise stretched proper care plans).

- Fool around with a cards one perks you for the get.

- Play with a credit with a high borrowing limit, and you will little to no established harmony.

Mark your calendar to invest the bill off entirely because of the the latest payment deadline. In the event that playing cards commonly your style, almost every other fund alternatives was online. If you have good credit, a personal loan are a low interest rate choice which will really works for the problem. Skyrocket Fund, for instance, has actually APRs as low as 7.161% that could be perfect for people repaying the loan that have minimum monthly payments.

Advertising Disclosure

Any views, analyses, feedback otherwise information shown during the article posts try of journalist alone, as well as have maybe not started assessed, acknowledged, or else supported by advertiser. I make sure you offer right up-to-date advice, however we really do not ensure the reliability of your guidance displayed. Users is to make certain fine print for the place offering the circumstances. Blogs get consist of some paid stuff, content in the connected entities, or blogs regarding the subscribers from the community.

Article Mention

Quicken Evaluate, a great LMB Opco, LLC company, is actually settled from the 3rd-party advertisers, yet not, any feedback, analyses, product reviews otherwise recommendations indicated into the article content was of your author alone while having maybe not come assessed, approved, if not endorsed by marketer. I make sure you offer right up-to-time suggestions, however we do not guarantee the precision of your pointers presented. People would be to guarantee one fine print to your business bringing products. Content will get consist of specific backed posts, stuff regarding associated organizations otherwise content regarding the customers on the circle. Quicken Contrast does list of cash advance stores in usa not include all the lenders or even offers in the marketplace. The content exhibited with the Quicken Compare or perhaps in it films does maybe not offer legal, financial, accounting or tax information.