Whenever you are within the a tough finances, it is tempting to obtain a payday loan. A payday loan can give you the money you would like to spend your expenses and keep maintaining your head above-water. Yet not, prior to taking aside an online payday loan, definitely envision all alternatives.

One choice that you could not have sensed is getting a good $50 pay day loan. This type of finance is quick, but they can give you the bucks you need to get by up until your future paycheck. And you may, given that rates throughout these money was apparently reduced, you can afford to invest them back quickly.

If you’re considering bringing a quick payday loan, be sure to contrast the attention prices and you can charge from the various other loan providers. You are able to get a loan provider that offers down interest levels and you may charges compared to of those offered by their bank otherwise credit partnership.

A personal debt which is due to your authorities in no way binds the brand new conscience of people. U.S. Supreme Court Fairness William O. Douglas. We offer a variety of mortgage issues having people to help you pick. We permit one borrow funds by allowing that comparison shop and you can located numerous financing choice at a beneficial single area, that have one application.

End

To summarize, cash advance can be helpful from inside the a time of you would like, however, should not be utilized due to the fact an excellent crutch. Borrowers is cautiously consider their options before taking aside a pay check financing and make certain they are able to afford to pay it back on time. Whenever they can’t, they should explore additional options such borrowing regarding friends otherwise loved ones, using credit cards or obtaining a personal bank loan. Find borrowing guidance particularly if you has actually a dismal credit background together with your prior loan contract out-of a primary lender.

How can i get a good fifty-money instant mortgage?

In the current discount, it isn’t unusual to get into a position the place you need some additional money fast. Perhaps the car bankrupt off and you should correct it, or perhaps you’ve got an urgent debts come up. Whatever the case tends to be, if you’d like a quick financing out of fifty dollars or faster, there are several solutions to you personally to save cash.

One to choice is to see a payday financial. Pay day loan providers offer short-label funds with high interest levels, but they are a quick and easy method of getting new currency that you may need. An alternative choice is always to take-out a personal bank loan out-of a good lender or borrowing from the bank union. Unsecured loans routinely have lower rates www.cashadvanceamerica.net/loans/loans-for-bad-credit of interest than just cash advance, nonetheless they can take stretched to techniques.

There are other solutions also, like taking right out a concept loan otherwise planning neighborhood pawn shop for help. There are many reasons that people sign up for payday loans out-of a pay check lender. It is very important ask for an instant payday loan organization one to has the welfare pricing. There are numerous an effective way to see if a payday financial can offer a beneficial otherwise bad rates of interest, but most companies render their interest costs online and that means you can see just how much it costs.

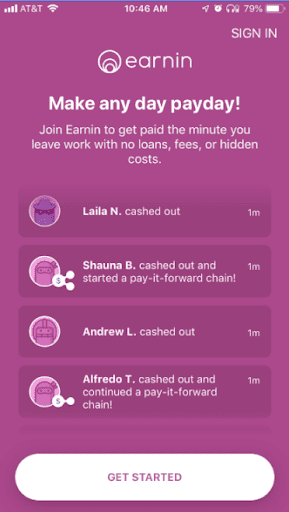

Just what app have a tendency to i want to use $50?

Financial institutions are perfect for much time-title offers and investments, exactly what on the if you want a little extra cash in a rush? For these times, there are numerous apps which can lend you currency.

- Credit Pub individuals normally discovered financing around $forty,000; rates of interest begin on 5.99%