Often School funding prize packages commonly sufficient to safeguards this new complete statement. When this occurs there are more possibilities and places to seem from the having let!(Delight contact Educational funding Qualities for lots more information and you will recommendations when the needed with the financing issues)

Whenever applying for even more funds, obtaining the full season (loan months ount will be separated ranging from Slip and Spring evenly. For those who merely need a semester loan make certain the loan period is the fact types of semester (Aug to help you Dec Otherwise The month of january to Can get Otherwise May to help you Aug). Accommodate approximately two weeks, of latest acceptance reputation, for the majority loans showing given that Pending to your account or expenses.

Quoting financing otherwise percentage package requires just before charging possess happened try easy with this device! Let our very own workplace determine if you need so much more help!

Parent And additionally Financing

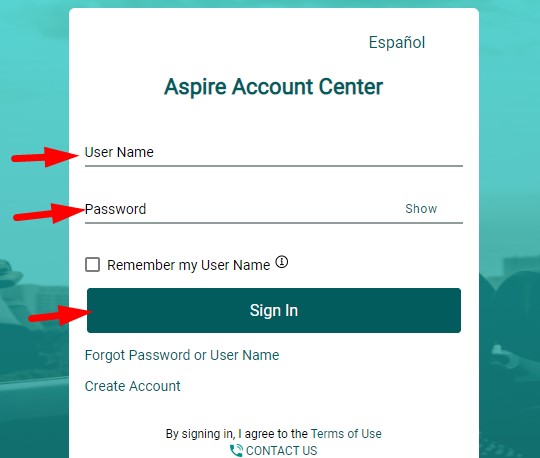

The brand new mother logs towards and their very own FSA ID and you will password. Below Parent Consumers click on Submit an application for an advantage loan. In the event your mother or father are:

- Accepted – they then need to finish the Master And Promissory Mention

- Denied – brand new college student ount off unsub Stafford Fund in their term. ($cuatro,one hundred thousand to your 12 months – 2,000 fall and you can dos,100000 spring – less origination charge).

Amount to make an application for – you will find an origination commission withheld from these fund by the servicer, in advance of disbursement with the college or university. This matter is roughly 4.228%. Such as, in the event the Plus loan was for just one, – the web amount to disburse (post) for the youngsters account manage just be . If you want 1, to publish to the college students membership, the borrowed funds software matter would-be step one,.

- The amount should 600 loan be leftover blank intentionally. This should allow the loan to be the maximum amount anticipate into semester and seasons – if this exceeds your circumstances delight reduce the mortgage just before disbursement. The borrowed funds changes means is on Financial Aid’s website.

- That one is not accessible to people who will be deemed independent by the School funding

- The new college student Need to be and then make school funding improvements (lowest cumulative GPA dos.0 and % completion rates) to get government support along with Parent As well as money. When the a student is not making progress for Stafford Funds they can not found Parent In addition to finance.

- Student have to be providing six loans or even more to use federal help eg Mother Including funds.

Option Finance

Talking about money a student consumes its identity which they need to pay right back, nonetheless they you need a cards-worthwhile co-signer. Review loan providers, their attention rates and implement all of the using one website elmselect. There are a few Moms and dad Option Financing available.

- Nj People Simply – check out to own Nj-new jersey Category Funds – pupil or moms and dad funds that have high rates!

- PA, Nj-new jersey, Ny, MD OH Residents Merely – listed below are some getting PA Forward Money – pupil otherwise parent financing which have high interest rates!

- Zero origination charge to adopt for some option funds, except Nj-new jersey Group money who’s roughly an excellent 3% origination percentage (at the mercy of transform).

Payment Arrangements

Glance at our very own webpages having information about how, when and where to join up! The earlier you signup, the greater the master plan! Questions relating to fee arrangements could be led to focus out-of Pupil Account.

Alerting! You should never Borrow more you would like!

We need the youngsters to get wise consumers and just capture financing which they truly have to pay their costs associated with college or university. If you learn that funds, or your own parent’s funds, be than just required, you could potentially lose people funds In advance of it disburse to prevent more-borrowing and you will minimizing the debt up on graduation. Consider, we shall not dump financing or terminate that loan without a completed means (apart from instructions throughout the financial or you withdraw regarding the semester otherwise KU).

Go to the School funding web page Forms and you may complete the Scholar loan change mode if your loan is a student-based loan Otherwise complete the Mother loan alter setting in case your loan is actually good parent financing.