A health crisis may come slamming from the one’s home whenever good people least wants it. While most people get ready for they by buying medical insurance, usually, this type of regulations cannot cover all areas of a health statement. Facts eg inadequate share insured, an ailment not receiving safeguarded underneath the plan, or a medical facility maybe not on the panel off insurer’s TPA (3rd party Manager), is also obstruct a person’s called for procedures. An unexpected need of such as characteristics might have you playing around requesting financial assistance off friends. In such instances, a choice way to obtain financing particularly a personal loan can come for the aid. We have found all you need to understand unsecured loans and you can why you need to bring her or him if there is a healthcare crisis.

A consumer loan to own a medical emergency try an easy loan facility that one may need during the an economic crisis such as a good scientific emergency. Many finance companies and you can NBFCs (Non-Financial Monetary Organizations) offer that it disaster financing to own heavier medical bills, session costs, diagnostics, etc.

Here are some Secret Benefits associated with Getting a consumer loan to have Medical Issues:

? Quick Processing: Respected financial institutions see the necessity of a healthcare emergency, and so they provide a complete digitized app processes with just minimal paperwork, hence letting you discovered financing rapidly . That loan having a healthcare crisis is eligible quickly and you will paid directly to a borrower’s account per day otherwise two, or occasionally sooner. Although not, it is important that borrowers meet with the qualification requirement.

? No guarantee: As this is a keen unsecured disaster mortgage you don’t have to care about pledging security or safety for this mortgage.

? Highest quantity of financing: It’s possible to apply up to INR twenty five lakhs* just like the a personal bank loan for a medical crisis to help you fulfil the scientific requirements effortlessly.

? Medication anyplace: You can make use of so it loan amount in just about any hospital otherwise personal procedures middle to own using expenses, diagnostics, an such like.

? Method of getting all the healthcare facilities: In place of medical care insurance procedures in which merely limited circumstances or steps rating safeguarded, al categories of procedures was possible with a medical emergency mortgage.

? Glamorous Rates: Some credit organizations give attractive rates of interest so you can individuals with a high qualifications. Your own qualification having a personal bank loan very depends on your revenue, years, credit score, repayment business or any other issues. Loan providers eg Fullerton Asia enjoys streamlined qualifications requirements and online application procedure that allows you to during the fulfilling your own medical financing standards easily.

? Immediate Fund: As confirmation and file assessment process could have been completed effectively, the lending company often approve your loan, once you gets the mortgage amount.

? Flexible Fees: Go back the disaster mortgage having Equated Monthly Instalments (EMIs). For the majority of Banks NBFCs, the quality cost months is actually ranging from 12 to help you 60 weeks.

EMI Computations to have Scientific Financing:

Equated Month-to-month Instalment ‚s the count one to a debtor will pay all times into the financial otherwise NBFC for taking the mortgage. It is calculated according to the loan amount, tenure interest rate. This new algorithm to assess EMI is actually,

Once the rates of interest are different for different banking institutions NBFCs, the brand new EMI differ. It is vital that you usually calculate your own EMI that meets your revenue and you can accordingly choose the right tenure with the scientific mortgage.

App Processes to own a medical Loan:

? Favor a respected financial whoever personal bank loan qualifications standards suits the character and provides the borrowed funds during the a cashadvancecompass.com/payday-loans-ct/riverside competitive rate of interest. Find the maximum amount borrowed you would like for the therapy by the checking the maximum amount you happen to be qualified to receive having fun with a unsecured loan qualifications calculator.

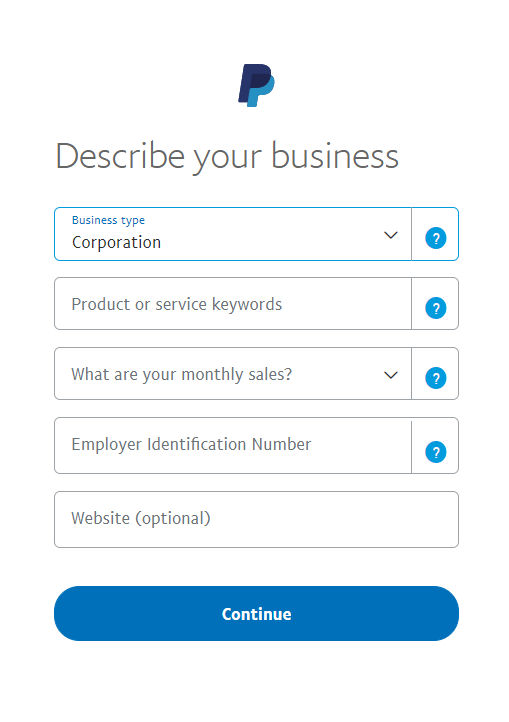

? To use, go to the lender’s webpages or down load its mobile app. Check in their cellular count with OTP confirmation to begin the excursion

? When your paperwork and you will confirmation process is actually effectively finished, this new approved financing might possibly be paid to the savings account.

An unsecured loan is a boon, especially in issues. The brand new easy and quick recognition processes, minimum paperwork and you will immediate disbursal may become a life saver. Therefore the next time you or the one you love you would like treatment and you need to plan short funds, you could potentially always submit an application for a personal bank loan.