I went into the this situation having a negative appraiserluckily with Liz’s [the mortgage manager] let, we had been able to get an alternate assessment bought, and it also proved far better

One question it is not fundamentally a disadvantage, but instead one thing to be aware of, is the fact that the assets needs to appraise into very first mortgage amount + the latest recovery will cost you, however it needs to appraise just before closing. So, for example, when the a property in its ongoing state is 100k, and renovation costs are 25k, brand new appraiser needs to glance at the suggested scope out of work, and appraise our home based on its future worthy of immediately following home improvements. Your realtor might be very important inside part of buy to get comps and create the full CMA (comparative field data) in order to make yes you’re not offering too-much into property.

The largest downside, undoubtedly, for all of us was that people could not become our very own GC. My hubby have a diploma during the and has did into the framework government for quite some time, so we were very bummed that individuals failed to organize this new subs ourselves. This lead to the brand new schedule we had been told getting significantly incorrect, having contradictory otherwise nonexistent telecommunications between the GC i selected and subs. We had in order to scramble for a few days trying to figure out in which we’d feel life style because they was so behind. As soon as we wanted the newest and you will proper timelines, the clear answer try constantly a couple of a great deal more days. It was extremely stressful. What was a-one-week schedule turned into four, while the subs weren’t sufficiently informed into importance off our very own schedule. Got we just started informed really initial, we are able to possess pursued a loan places Joppa temporary leasing.

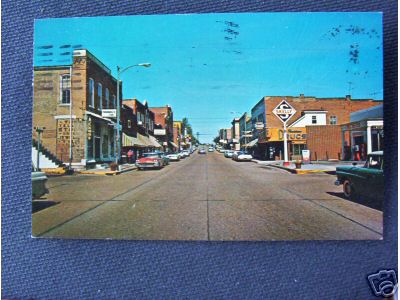

A routine domestic that could be a candidate to have a repair mortgage does not focus average people, especially in the present day business

- Tune in to exactly what stuff you must have over, and you can what can hold off. Would it was indeed very nice to engage from indoor painting into the the loan as well? Yes! But, we understood we can take action our selves for a portion of the price, regardless of if it got a little while. We knew we are able to live with the bathrooms since the-is actually for brand new near future. They aren’t stunning yet, however, they’re useful.

- I portrayed united states since a client’s agent into the transaction, and so i has already been used to our home-to buy processes as a whole. If this sounds like your first family-buying feel, be equipped for particular tiring moments. Ask your agent plenty of questions initial. Keeps it caused historic services? I’ve seen several agencies who think particular solutions try natural crises (replacing wood screen pops into their heads… ugh), not realizing that it’s just part of the territory out of a keen dated house. Keeps it worked with recovery fund? Provides it caused first-go out buyers? What’s the house-purchasing process as with your state?

- Including, do your research into the income tax loans. Attributes about Federal Register regarding Historical Towns and cities meet the requirements to possess some very nice loans, however you need stick to the best documents process. Your contractor will have to discover that it. There will probably even be regional taxation credits readily available (having NRHP and you will state-appointed historic areas), and additionally they may have her records procedure as well.

Would suppliers score turned off an individual desires to buy the home with a great reno mortgage, knowing it may take a while lengthened to shut?

Really people that aren’t traders or flippers need a shift-in the ready otherwise nearly-move-in ready domestic. From the one really meaning, [the belongings which need particular really works was] likely to take a seat on industry a bit more than average. In some instances this type of could be property that vendors see tend to you need upgrading and you can fixes, therefore seeing that a purchaser gets financial support that may target those things must not be badly shocking. A good reno mortgage will normally get 45-60 days to shut, while you are a fundamental 30-year try a thirty-45 weeks to close affair. Therefore, you ought to make sure your real estate agent understands your local industry and is able to present the deal such that is reasonable into number representative, therefore the merchant understands just what conditions on the offer really imply.