Or even be eligible for one another mortgages outright, you will need to promote your own bank with proof you are renting out your current family before the contingency several months ends.

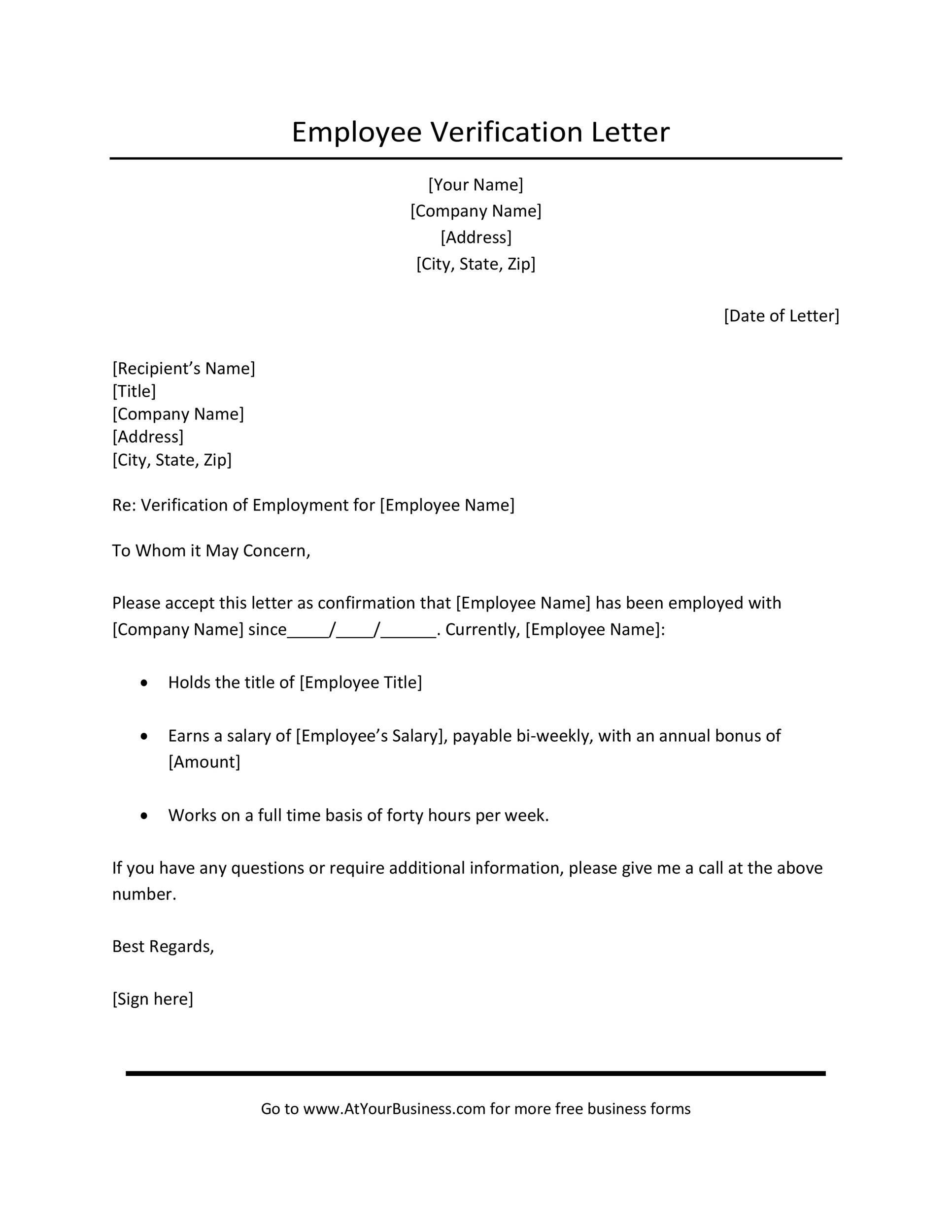

Generally speaking, loan providers will want to see a duplicate of your own legitimately performed book and you may a protection deposit check once the facts that the occupant has actually committed to rent money one to reduce your month-to-month houses expenditures. With this records available, the lending company tend to procedure and you may approve the mortgage, and will also be prepared to intimate on the new house.

A lot of the borrowed funds techniques try time-delicate, if in case you will want to get a hold of a renter ahead of closing into your brand-new property, the fresh timelines score actually firmer. We all know away from feel one to conference the rigorous approval due dates tend to relies on the group you happen to be dealing with.

All of our every-on line processes is made to produce the loan you prefer when you look at the list go out. We broken they into four basic steps to help you get accepted to have an additional home loan to your yet another household:

1. Rating pre-acknowledged.

The way to lose a lot more stress and avoid you’ll roadblocks later on is to use to possess pre-recognition with a supporting and you may qualified financial-such as all of us!

Which have a pre-acceptance page within your bring, the realtor should be able to expedite the procedure on supplier while having the ball moving on your own formal mortgage recognition as fast as possible.

Once you’ve discovered our home you want to buy, it is the right time to generate a deal. Submit their pre-approval page together with your provide therefore, the buyer understands you will be currently proactively dealing with a loan provider to suit your financial.

Be sure that you have enough time locate a tenant, also. Exit your self big date from the day out-of desired towards the closure day (home loan contingency date), being select a renter and you can carry out a valid rent.

step three. Look for an occupant and carry out a rental.

Lookup book viewpoints, promote your property and acquire a renter so you can rent your property. You can deliver the lease and you will proof the security deposit to the lender within your qualifying towards brand new home mortgage.

Bear in mind, as well, that you ought to perform a rent and you will gather a protection deposit up until the financial backup expires.

cuatro. Discovered final mortgage recognition out of your bank.

Once your bank has already established proof a valid lease and you will that you’ve compiled a safety deposit, they shall be capable procedure and you may commercially accept the borrowed funds. When this finally mortgage acceptance is during give, you will be set to intimate in your new house!

On NewCastle, we think inside simplifying the mortgage techniques and you can empowering the customers to the degree they need to with full confidence purchase property. Due to the fact daunting that techniques may sound to start with, we have been invested in getting the inquiries responded, and you can making clear your path to the domestic you would like.

Continue to have questions relating to leasing out your current domestic? Like to see in case your state fits the method we’ve got discussed above? Willing to get pre-acknowledged. Our team is able to help!

Let’s say you bought a property inside 2018 which is today as well short for you personally. You adore your house and you may are not ready to put it on the market industry, nevertheless can’t afford to fund two mortgage loans outright provided your earnings. You determine to rent your existing house, and you will, in accordance with the local rental market, have a tendency to collect $dos,one hundred thousand inside lease monthly. When a lender qualifies you for the brand new mortgage, they are going to consider your adjusted monthly rental income getting 75% of this $2,one hundred thousand, otherwise $step one,500 per month. It $step one,500 might be used to counterbalance your home loan financial obligation, that will help you Northglenn loans qualify for another financial into the another home.

That have $six,014 during the monthly expenses and you can $11,one hundred thousand inside the monthly earnings, this puts Jessica’s DTI at 55%. ($6,014 / 11,000 = 0.5467 or %)

And even though it’s true one 30-or-therefore weeks seems like a difficult deadline to fulfill, again-the genuine home and you will local rental places flow prompt! Into the backup months, you will have time for you to market and feature your property to help you possible renters, then set up a rent arrangement for the occupant(s) while the mortgage lender will get that which you together with her in order to procedure and you will agree your loan.