Regarding reaching life’s significant financial milestones, even more moments than perhaps not you would not have the ability to pay for your get during the bucks. That’s where the latest advance payment comes in. It could be looked at as a financial investment during the yourself, because it’s making it possible to reach finally your economic desires, whether or not to shop for a special family otherwise auto or promoting the education.

One which just just do it that have making a primary buy, you should think about this expense plus the matter you can manage to pitch when you look at the on the the purchase price of your resource.

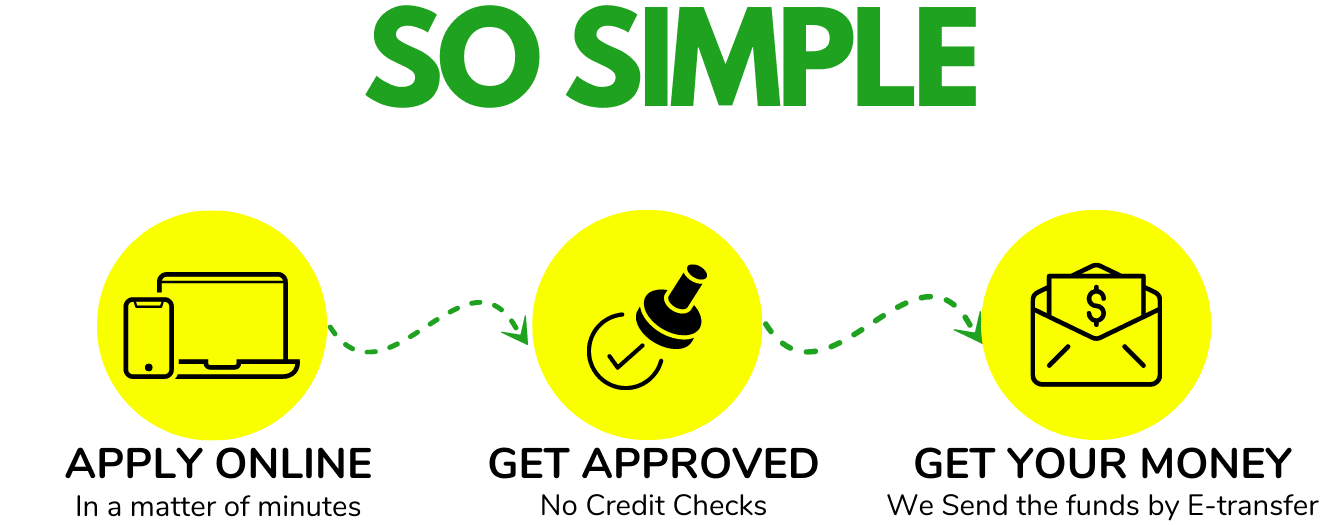

loans for people that have no checking account

On this page, we are going to answer popular concerns, like What is good advance payment to have property?’ and you can What’s the mediocre downpayment to have a house?’, among most other related basics.

With regards to real estate, a down payment was a swelling-share number paid back by homebuyer. This can be part of the property rates and it is ount you to a lending company will give.

In reality, the downpayment in manners set the tires for the activity for the mortgage. How big is brand new advance payment may differ according to the types of out of financial where the fresh homebuyer might have been approved.

What if you’re purchasing property having $250,100, along with your down-payment are $10,one hundred thousand, otherwise cuatro% of your own purchase price. You will have to safer a home loan to your equilibrium of the price, otherwise $240,100000.

The higher your down-payment, the reduced the loan loan amount must be. For many who you’ll manage to put 20% down, or $50,one hundred thousand, their mortgage might be less.

One-term that homeowners can expect mortgage brokers to make use of was the borrowed funds-to-worthy of, otherwise LTV, ratio. So it payment shows the active involving the mortgage’s proportions while the property’s really worth shortly after an appraisal.

So, using the more than example, by getting down $fifty,000 into the a beneficial $250,000 household, your LTV ratio are 80%, and you have a beneficial 20% security possession throughout the property.

The size of a good homebuyer’s advance payment requirements may differ according to the sort of mortgage wherein it qualify. Lower than are a breakdown of the many kinds of financial things in addition to down money from the her or him:

- A keen FHA financing, which is you to definitely supported by the fresh new Government Property Administration, means a downpayment with a minimum of step 3.5% of your property’s assessment well worth.

- A conventional home loan you may require an advance payment of ranging from step three-15% of your own cost. The particular count involves a variety of circumstances set forth from the Fannie mae, Freddie Mac, as well as the lender.

- Jumbo loans are designed for homeowners whose mortgages take the fresh new high top and land which might be into the pricier side. Consequently, they tend to require down repayments regarding 20% or even more.

- For many who be eligible for a good Va financing, you could potentially most likely get a house with zero deposit. A similar retains to own a USDA mortgage, although the property must be located in a being qualified rural area.

Complete Financial have positives standing from the that will help you on home loan app procedure. Find the right mortgage to you personally, whether or not a house get or refinance, and now have a free speed quotation today.

Maybe you are wanting to know what an adequate amount for a lower payment could well be. According to Consumer Economic Protection Bureau, homebuyers should expect to blow a minimum down-payment getting an effective family of 3% of your property’s rates. But not, oftentimes, that matter are certainly more including 5% or more.

One thing to bear in mind is the fact that the high the newest off fee, the more discounts the latest homebuyer has a tendency to reach along side life of the loan mortgage. To respond to practical question out of what a large amount to own a deposit could well be and more, let’s crack it off next:

- A good deposit with the a house: This can be personal and ought to be the ideal down payment your can afford to make. Understand that the better their deposit, the greater attractive your own risk reputation will be to a mortgage bank. This might lead to greatest cost for the financing.

- Minimal downpayment on the a house: Because the revealed over, minimal down-payment may vary according to the financing kind of. However, something to remember would be the fact, based on Bankrate, since , the average family price is $352,800. Predicated on this number, the minimum deposit of step 3% to possess a traditional mortgage is actually $ten,584.

- Mediocre down payment on the a home: According to a western Family unit members Insurance rates survey, the average sized a downpayment range anywhere between $ten,100 and you can $fifteen,one hundred thousand, which is up to 5-6% of your own property’s purchase price.

Advantages of a massive Advance payment

And also make a large downpayment may appear eg a primary difficulty at your home purchasing processes. Yet not, in return for quick-title discomfort, you will see a long-title get. This is because the higher the brand new advance payment, new smaller the fresh new borrower should pay-off over the financial mortgage label.

This may translate to reduce monthly payments, paying shorter attention on financing, and much more total coupons on the homebuyer. It also setting the latest homebuyer should have additional money move left more that they could direct to the most other expenses or perhaps to help save for the next deposit.

If you’re unable to afford to make big downpayment, cannot worry. Discover advantageous assets to a lower down-payment amount, as well. Through a smaller sized down-payment, you have more funds that you could direct on the the fresh new additional expenses, such as for example closing costs or any other fees, such, aside from all other purchases which you can want to make your new domestic a property.

Discuss Financial Solutions out-of Full Home loan

Now that you know about brand new ins and outs of down commission, youre well on your way so you can gaining your aim out-of owning a home.

Before you go, contact Total Home loan. We now have branches scattered nationwide, certainly that is certain to get into your area.